Do you want to know about the difference between buying a company and selling a company? As a matter of fact, both tasks are proved to be cumbersome. Minor mistakes can lead to possible disputes. And the main difference between these two terms is ‘what you paid and what you sold it for’, of course, is your profit. Are you ready to embark into this new journey of buying and selling companies?

If so, then it is strongly advised that you need to review and rectify all the CPA Forensic Accounting of the enterprises so that you can operate your business legally. Let me explain how I have applied my knowledge to make our first acquisition and how you can also grow your business through an acquisition.

Well, having been involved with buying over a dozen companies, and selling 5, I have done a lot of work in M&A. But I want to notify that while the acquisitions came before the sales and were spread out over a longer period, both types of transactions are equally impressive.

In most of the early acquisitions, from 2008 to around 2014, I have done mainly accounting for the companies. What is more, I have handled purchase accounting, integration of the finances, reporting and related matters. Sometimes, these tasks proved to be complicated, as goodwill and intangibles had to be valued. Over time, I did it so often that I became certified in valuations.

It started to become somewhat routine, at least as far as the post-closing side of things. That’s why with my experience, I believe that all the business owner need to go beyond their own guess of the company’s value and take help of a valuation expert in order to satisfy section 409a Valuation.

As a matter of fact, 409a valuation determines the fair market value (FMV) of the company and is set by a third party valuation services. In order to do it completely, business people should take the help of professional firms. In fact, with the advent of technology, now there are a plethora of 409a valuation methods which you can choose as per the requirements of your business.

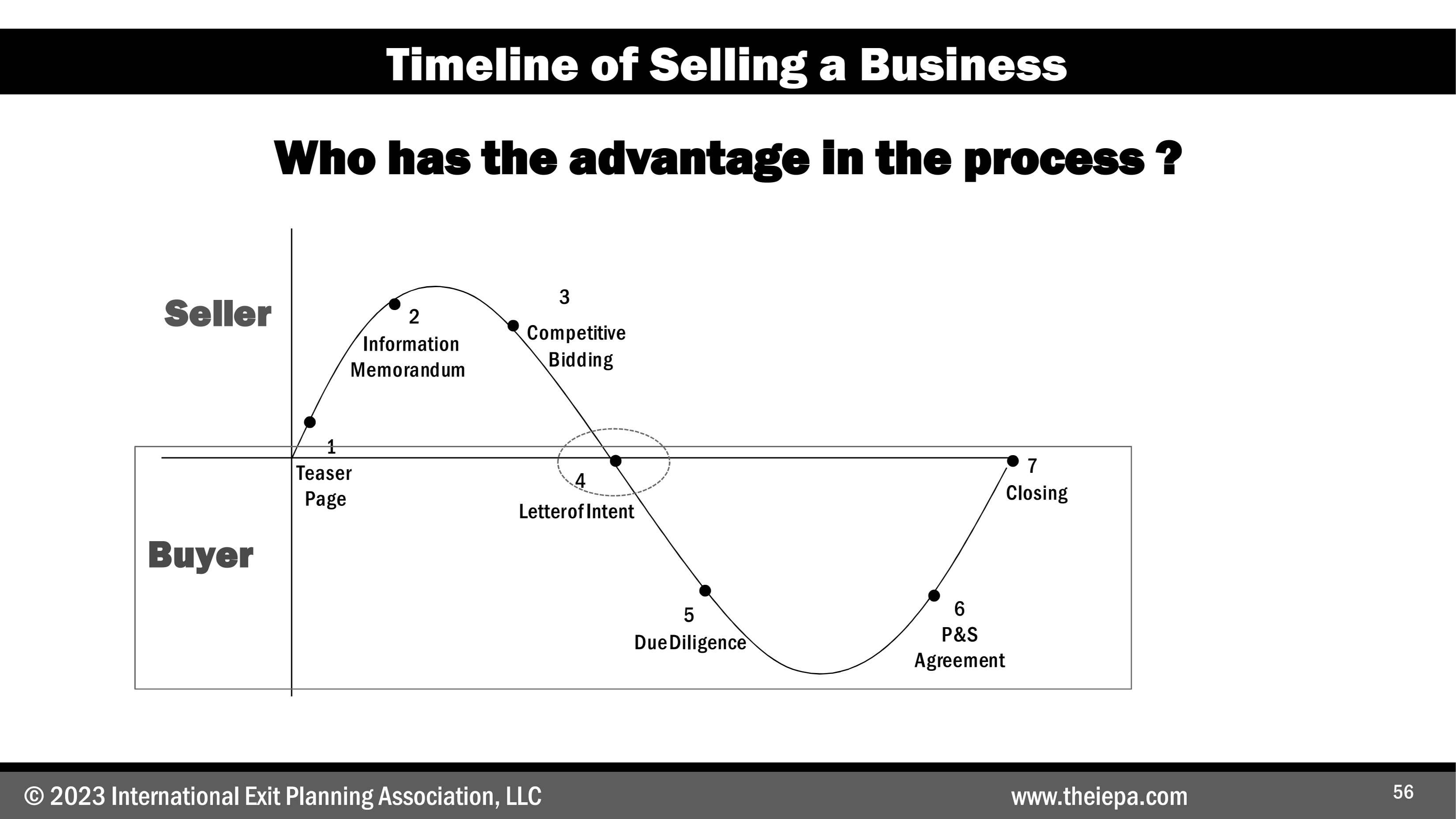

However, as for the due diligence, this process too started to form a pattern. Selling a company can be harder than buying a company. It’s up to the buyer how much due diligence they want to do. For sellers, they have to respond to the buyer’s due diligence questions, so the control is more with the buyer.

Let’s go through the pros and cons of each.

Buying a Company

As a matter of fact, instead of starting up a business from scratch you can just gather up all the money and resources and buy an existing one. However, there are going to be risks involved, but you already know that. Let’s start with the advantages of buying products before going through the disadvantages of that-

The pros of buying a business are as follows.

1.CPA Forensic Accounting-

Buying an existing business gives you a good idea on the value of products or services, as the market has already tested them. You have a sense of the reaction of the market to the products, which helps you to either improve or maintain its standard. Moreover, while doing Cpa forensic accounting for your business, you don’t need to worry about the documents and other requirements for use in a court of law.

2.Time-Saving

You’ll reduce startup time significantly. The hardest part about any new franchise is the startup, but by buying an existing business, you bypass that as well as gain more benefits, such as; trained staff, prior relationship with market and suppliers, technical know-how, and much more.

3.Customer Access

You’ll have access to the customer base. You don’t need to go and build a network of new customers, with buying an existing business you have access to the previous and existing customers to sell your products too.

Unfortunately, it is not all rosy. There are some demerits also-

The cons of buying a business are as follows:

1.Documentation and Finances

You might be scammed. Most times people don’t sell a business that is thriving. You may not have a completely clear picture of what you’re buying due to misrepresentation of data and finances. In this case, you need to hire CPA Expert Witness that can at least help you in preparing all your budgets and other requirements.

2.Staff Rearrangement

You could end up dealing with more than what you bargained for. You may have serious staff issues or you might need to change some existing policies.

All in all, it may be overwhelming. Overwhelming in the sense that you’re stepping into another person’s dream and trying to change it into yours. The transition of ideas, policies and goals could just be too cumbersome. Taking time to think about things before making that final decision of buying a business is the key to its success, as it is filled with pros and cons.

Selling a Company

Well, selling a business is not as simple as most people think. In fact it is more complicated than buying a company. A single wrong footing and the lasting damages could prove to fatal for the entrepreneur and the buyer, but if you know the pros and cons, it’ll help you make a learned choice.

Unlike buying a business where the pros and cons are clearly stated, the pros and cons of selling a business are not written in stone.

It all boils down to which pays you most.

An Outright Sale

This is where you sell the business when you have reached a point where you can’t take it any further. There are two types of outright sale. The asset sale and the stock sale.

This is where you sell the business when you have reached a point where you can’t take it any further. There are two types of outright sale. The asset sale and the stock sale.

So, what you mean by these words?

But before highlighting the information about these keywords, it is better to have a CFO expert witness that will help you in contributing sound strategic financial leadership.

The asset sale means selling the assets (equipment, facilities, customers, intangibles, etc.) of the business except for the business itself. This benefits the buyers more than the sellers.

On the other hand, stock sales mean the sale of the business itself and all its assets. This also exposes the buyer to all of the existing problems of the business.

Verdict

There is no denying the fact that every rose has a thorn, similarly, buying a business and selling a business both have some merits and demerits. However, some believe that buying a business is less stressful than selling one.

But I believe that by understanding all the options and getting good advice from expert professionals, the sale of a company could be made beneficial for everyone involved, from the buyer to the seller to the customers. If you want to have some professional help than get in touch with us at HP Accounting. We assure guaranteed solutions and optimized results.